All Categories

Featured

Table of Contents

We're chatting top-tier cooperation, smooth updates, and storage that expands with you. Ignore information calamities; this is regarding maintaining your operations smooth and your mind secure. There you have it. The tax obligation sale overage industry is still going solid. To make the most of it and increase above the competitors, consider the tools and ideas stated in this write-up.

And where do you really feel stuck? Get to out to the pros in the sector. Their knowledge can make your journey worth it every action of the method.

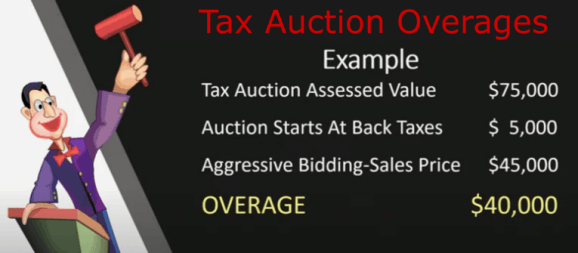

These can develop into considerable gains for wise financiers who know where to look and how to navigate the procedure. That's why comprehending tax overages and the ideal states to find them is a game-changer in your financial investment trip. In this post, we'll check out: The idea of tax overages and why they matter for real estate investors Who can take advantage of tax overages and just how to get started The leading states that use profitable chances for tax obligation overage investments CaliforniaUp to 5 yearsHigh-value residential or commercial properties, affordable overagesTexas6 months to 2 yearsLarge cities, varied excess potentialFlorida1 to 2 yearsPopulation growth, high residential or commercial property turnoverGeorgia1 to 12 monthsHigh-density areas, adequate chances for overagesArizona3 yearsRising residential property values, solid actual estate marketOhioVaries (typically 1-2 years)Abundance of older properties with overage potentialColorado3 to 5 yearsIncreasing home worths in particular regionsIllinois2 to 3 yearsMix of urban and suburban buildings for explorationNorth Carolina1 to 2 yearsGrowing cities, potential for overagesTennessee1 yearDiverse residential or commercial property choices for prospective overagesIndianaVaries (generally 1-2 years)Country and urban residential properties with overage potentialMichigan1 to 2 yearsDistressed buildings, capacity for substantial overagesMissouri1 to 3 yearsMix of residential and business propertiesVirginia1 yearGrowing population, diverse property opportunitiesNevada2 yearsBooming real estate market, capacity for overages Note: The table offers a succinct overview of the crucial attributes of each state for tax overages.

Tax Homes Sale

Currently that you comprehend just how tax obligation excess occur, it's time to determine which specifies offer the juiciest opportunities. Not all states are produced equivalent when it pertains to tax obligation excess. Some have more positive conditions than others. 1.: Each state has its very own legislations controling tax obligation sales and overages.

Much shorter redemption durations might mean quicker accessibility to overages. Some states may have fewer investors competing for excess, providing you a much better possibility to score large.

: Assess the realty market in each state and analyze the potential earnings of tax obligation overages. Abundance of tax sale buildings Generous redemption durations (approximately 5 years) High-value residential or commercial properties and affordable overages Wide selection of tax sale residential or commercial properties Beneficial redemption durations (6 months to 2 years) Large cities provide significant overage potential Substantial tax sale stock Fairly brief redemption durations (1 to 2 years) Constant populace development and high property turn over Financially rewarding tax sale market Sensible redemption periods (1 to one year) High-density locations supply enough possibilities for overages Active tax lien state Redemption duration of 3 years Climbing residential property values and strong realty market Secure tax sale market Redemption periods differ (generally 1 to 2 years) Wealth of older homes with potential overages Tax lien state with great potential Redemption periods ranging from 3 to 5 years Increasing residential property values in certain regions Established tax sale system Redemption periods between 2 to 3 years Mix of urban and rural residential or commercial properties for expedition Stable tax sale market Redemption durations of 1 to 2 years Expanding cities present chances for excess Energetic tax lien state Redemption duration of 1 year Diverse residential property choices for potential overages Durable tax obligation sale inventory Redemption durations differ (normally 1 to 2 years) Both country and urban homes offer potential overages Well-regulated tax sale market Redemption periods of 1 to 2 years Troubled properties can generate substantial overages Beneficial tax sale setting Redemption periods between 1 to 3 years Mix of domestic and industrial buildings Solid tax obligation sale market Redemption durations generally 1 year Growing populace and diverse real estate possibilities Active tax obligation lien state Redemption duration of 2 years Thriving real estate market with possibility for overages Prior to diving hastily right into, it's vital to be familiar with the lawful factors to consider and potential risks entailed.

Discover efficient threat administration approaches to safeguard yourself from prospective mistakes and unanticipated challenges.: Find out the significance of carrying out thorough due persistance on homes and recognizing any kind of potential encumbrances. Currently that you have a solid understanding of tax excess and the lawful landscape, it's time to focus on strategies that will certainly provide you a side in this exciting investment realm.

While tax obligation overages use exciting leads, it's crucial to be aware of the challenges and prospective pitfalls that occur. In this section, we'll shine a light on usual challenges you may come across on your tax obligation overage journey.: Variations in the property market can impact the success of tax obligation excess.

Back Tax Properties For Sale

: Unforeseen liens or encumbrances on residential properties can affect your capacity to declare tax overages. As even more capitalists acknowledge the capacity of tax obligation excess, competition might raise.

Yes, numerous experts specialize in tax obligation excess and can guide you with the process. A number of online courses and workshops provide training on tax sale excess, helping capitalists navigate the complexities of this specific niche.

Tax obligation excess take place when a residential property is sold at a tax obligation sale for more than the owed back tax obligations, penalties, and fees. Typically, tax overages are held by the county or state government.

Some states or counties might charge a nominal charge for handling cases, while others could supply this solution for complimentary. Home owners are generally informed by mail if there are overages to insurance claim.

Yes, some investors specialize in acquiring buildings at tax sales, intending to benefit from excess. Nonetheless, it's important to perform thorough research and comprehend the involved threats. In cases where several celebrations (e.g., beneficiaries) declare the very same excess, the issue may need to be cleared up in court or with arbitration.

It's suggested to seek advice from a tax specialist to recognize any type of tax obligation ramifications. Mehedi Miraz is the enthusiastic writer behind With a love for creating and a fascination for the world of residential property, Mehedi has honed his competence with years of specialized study. His words take a breath life right into every aspect of the industry, making complex topics straightforward and satisfying to explore.

2020 Delinquent Property Taxes

If you are, consider venturing into the globe of repossession excess. In this informative blog site article, we'll damage down the procedure of starting a foreclosure excess company in basic, easy-to-understand terms. Before we study the details of starting a repossession excess organization, it's essential to understand what foreclosure excess are.

The excess funds, or excess, are legitimately due to the previous property owner or other qualified events. Beginning a foreclosure excess organization calls for a fundamental understanding of the procedure.

Back Tax Homes For Sale

Acquaint on your own with the legal regulations in your state pertaining to the handling of repossession excess. Foreclosure regulations can differ substantially from one state to another. It's crucial to research and recognize your state's certain regulations pertaining to foreclosure excess. In some states, the process is simple, while in others, it can be quite complicated.

Latest Posts

How To Find Tax Foreclosure Properties

Property Tax Delinquent Sale

What Is Tax Lien Investing